Tale of Two Ledgers: Tesla’s $1.4 Billion Discrepancy Raises Questions About Musk’s Government Waste Claims

Jump to:

A Study in Contrasts: Corporate Accounting Gaps versus Government Fraud Claims

A comprehensive Financial Times investigation has uncovered a $1.4 billion discrepancy in Tesla’s financial reporting, creating a striking contrast with CEO Elon Musk’s aggressive campaign against purported government waste and fraud. The revelation comes as Musk, in his role leading the Department of Government Efficiency (DOGE), has made sweeping but largely unsubstantiated claims about massive fraud in federal programs while simultaneously overseeing a company with its own significant accounting questions.

According to the Financial Times analysis, Tesla reported spending $6.3 billion on “purchases of property and equipment excluding finance leases, net of sales” during the second half of 2024. However, the company’s balance sheet shows that property, plant, and equipment assets increased by only $4.9 billion during the same period, leaving $1.4 billion unaccounted for, which the Financial Times characterized as having “gone astray.”

“Such anomalies can be red flags, potentially indicative of weak internal controls. Aggressive classification of operating expenses as investment can be used to artificially boost reported profits,” the Financial Times report states.

Tesla has remained silent on these financial discrepancies, declining to respond to multiple requests for comment from financial journalists. This silence stands in stark contrast to Musk’s vocal and frequent assertions about government waste, creating what critics describe as a double standard for financial accountability.

Unsubstantiated Claims versus Documented Discrepancies

While Musk has been unable to explain the $1.4 billion gap in Tesla’s financials, he has made sweeping claims about waste and fraud in government programs. Musk recently characterized Social Security as a “Ponzi scheme” and claimed there is $500 to $700 billion in annual waste and fraud within entitlement spending, assertions that factcheckers have found lack evidence.

The White House has attempted to support these claims but relied on misrepresentations of government reports. For instance, while citing a Government Accountability Office report that stated the federal government “could lose between $233 billion and $521 billion annually to fraud,” the White House statement inaccurately presented this as an actual rather than potential figure and falsely claimed that “most of that is within entitlement programs.”

“The White House is mugging the truth to foster the impression that Social Security, Medicare, and Medicaid are ridden with fraud,” concluded one analysis examining Musk’s claims about government spending.

When examining actual government reports, the contrast becomes even sharper. The Social Security Administration’s inspector general found approximately $72 billion in improper payments between 2015 and 2022—less than 1 percent of total benefits paid during that period. By comparison, Tesla’s unexplained $1.4 billion discrepancy represents a much higher percentage of the company’s reported capital expenditures.

Corporate Financial Red Flags versus Mass Government Firings

Beyond the unexplained capital expenditure gap, Tesla exhibits additional financial practices that have raised concerns among investors and analysts. Despite claiming to hold approximately $37 billion in cash reserves, the company raised an additional $6 billion in new debt last year—a puzzling decision in a high-interest environment. Additionally, Tesla has neither initiated share buybacks nor offered dividends despite reporting substantial cash flow.

Financial experts have begun drawing parallels between Tesla’s accounting patterns and previous corporate financial scandals. Jacek Welc, professor of corporate finance at SRH Berlin University of Applied Sciences, has compared these red flags to patterns observed in notorious financial fraud cases like Wirecard, Longtop Financial Technologies, and NMC Health.

“When we see this combination of inconsistent financial reporting, debt-raising despite claimed cash reserves, and reluctance to return capital to shareholders, it often signals deeper issues within a company’s financial structure,” explains an independent financial analyst specializing in identifying corporate accounting irregularities.

Meanwhile, DOGE has moved to terminate or force out thousands of employees at the Social Security Administration, reportedly as many as 10,000, based on claims of waste and fraud that government inspectors general have not substantiated at anywhere near the scale Musk has alleged. The mass downsizing at the agency has resulted in “a significant loss of expertise,” according to former employees, potentially compromising service delivery to vulnerable populations.

Dismantling Cybersecurity While Facing Governance Questions

The corporate governance concerns at Tesla take on additional significance when considered alongside Musk’s approach to government cybersecurity. Under DOGE’s direction, numerous cybersecurity safeguards within the federal government have been eliminated or reduced.

DOGE has fired top cybersecurity officers from various agencies, gutted the Cybersecurity and Infrastructure Agency (CISA), and cancelled at least 32 cybersecurity-related contracts with the Consumer Financial Protection Bureau (CFPB). Cybersecurity experts warn these actions could expose sensitive citizen data and critical infrastructure to increased risk.

“I see DOGE actively destroying cybersecurity barriers within government in a way that endangers the privacy of American citizens,” said Jonathan Kamens, who oversaw cybersecurity for VA.com until February. “That makes it easier for bad actors to gain access.”

The CFPB, which had implemented multiple layers of protection for sensitive financial data, has seen many of these safeguards dismantled under DOGE. “The software we had in place tracking what was being done was turned off,” reported Erie Meyer, former chief technologist at the CFPB who resigned in February after DOGE members requested data privileges. This means DOGE employees could now access sensitive financial information without oversight regarding how or why they are accessing it.

These actions occur as Tesla itself faces questions about financial transparency and governance, creating what critics describe as a concerning pattern across Musk’s spheres of influence.

Market and Public Consequences

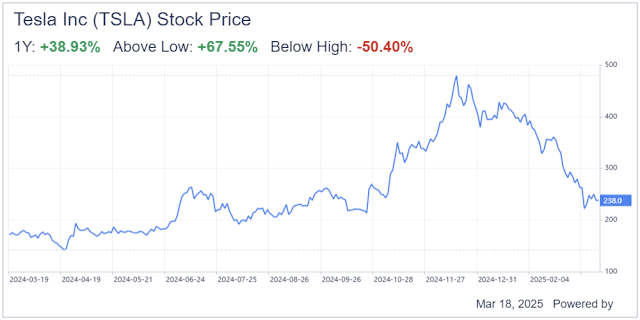

The market has already rendered a harsh judgment on Tesla amid these financial questions, with the company’s stock losing 50% of its value in a matter of weeks. This precipitous decline has wiped out billions in shareholder value and raised questions about the company’s financial future.

Similarly, DOGE’s actions at the Social Security Administration have created significant public concern about service delivery for beneficiaries. With thousands of employees removed, including many with specialized knowledge, experts warn that essential services like Medicare reimbursements or disability payments could be disrupted.

“They have fired the people who know where the danger points are,” Kamens warned, noting that mistakes within delicate government systems could have far-reaching consequences for vulnerable citizens who depend on timely benefit payments.

The apparent contradiction between Musk’s crusade against government waste and his own company’s financial discrepancies has not escaped notice from financial analysts, government watchdogs, and lawmakers. Senator Elizabeth Warren has questioned DOGE’s priorities and approach, expressing concern about potential national security implications.

Accountability Questions on Both Fronts

Securities law experts suggest that the identification of such a significant discrepancy at Tesla could potentially trigger closer examination from the Securities and Exchange Commission, which has previously brought enforcement actions against the company and Musk for misleading statements.

Meanwhile, legal challenges to DOGE’s authority and actions continue to mount. A federal judge recently questioned government attorneys about why DOGE needs access to Social Security Administration systems and is considering whether to restrict this access. Another lawsuit, filed by 19 state attorneys general attempting to block DOGE’s access to the Treasury Department, remains ongoing.

“When a respected financial publication identifies material inconsistencies in financial reporting, it typically draws regulatory attention, particularly for a company of Tesla’s visibility and market importance,” notes a corporate governance expert.

The parallel controversies raise fundamental questions about standards of accountability in both the private and public sectors. Critics point to what they see as an incongruity: while Musk aggressively pursues theoretical government waste based on limited evidence, his own corporate leadership faces documented financial irregularities that have triggered significant investor concern.

Looking Forward: Unanswered Questions on Both Fronts

As these dual controversies unfold, several crucial questions remain unanswered: What explains the $1.4 billion gap in Tesla’s financial reporting? Why did the company raise additional debt while claiming substantial cash reserves? And how can these corporate governance issues be reconciled with Musk’s role in overseeing government efficiency?

Similarly, questions persist about DOGE’s approach to government operations: What evidence supports the claims of massive fraud in entitlement programs? What will be the impact of cybersecurity reductions on national security and citizen data protection? And how will the removal of thousands of experienced government employees affect service delivery to vulnerable populations?

For now, the contrast between demanding accountability from others while facing accountability questions himself has created what critics describe as a credibility gap for Musk across both his corporate and governmental roles. Whether this gap can be bridged depends largely on whether transparency and evidence-based approaches can replace assertion and unsubstantiated claims in both spheres.

What are your thoughts on this issue? Join the conversation below.